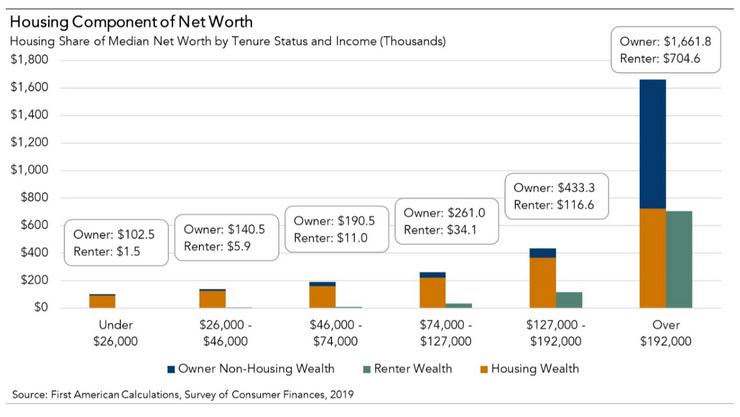

Home ownership is widely viewed as one of the best ways to accumulate wealth. According to the 2019 Survey of Consumer Finances, a triennial survey that collects detailed accounts of households’ finances, the median homeowner has 40 times the household wealth of a renter – $254,900 for the former compared to $6,270 for the latter.

According to calculations by First American, between 2016 and 2019, housing wealth was the single biggest contributor to the increase in net worth across all income groups, accounting for 32 percent of the overall increase. This was especially true of lower income households. For households at the bottom of the income distribution, the value of housing wealth increased by $21,000 – more than all other asset types combined.

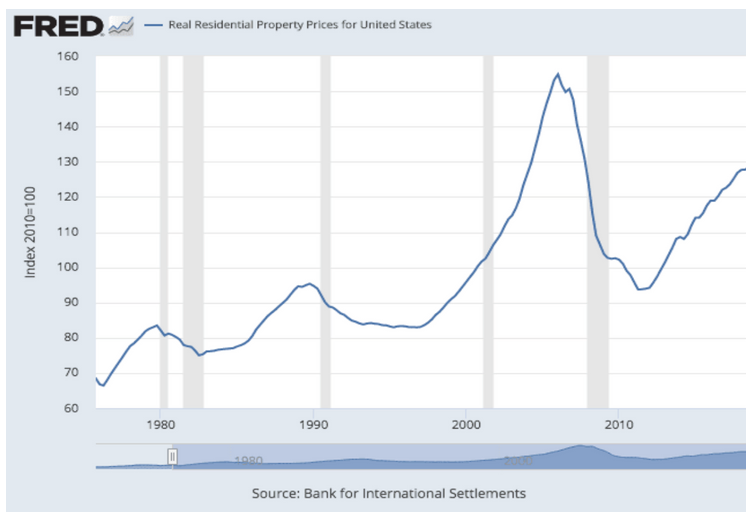

Wealth is created when a homeowner builds up equity through house appreciation or by paying down the mortgage. Significant wealth creation doesn’t usually happen in just a few years, it is much more a long-term investment. U.S. residential year-over-year home price appreciation averaged 1.89% from 1997 to 2017, adjusted for inflation, according to CoreLogic, the Bureau of Labor Statistics, and the Urban Institute.

However, behind that average are some major year-over-year price swings during the same period, ranging from a gain of 12.6% to a drop of 18.1%, according to the Urban Institute.

When it comes to short-term home appreciation and the equity it drives, sometimes it’s more of a bungee jump than a climb. Especially if you consider the local nature of housing and the variations in local markets.

According to housing price forecasts by Weiss Analytics, one of the foremost housing valuation and housing related data companies, there are some areas that have a big disparity in the coming year. Home values in Columbus, NE, Lexington-Fayette, KY, Kokomo, IN, Danville, KY and Knoxville TN are all expected to increase more than 10%. Meanwhile areas like Oxford, NC, Pottsville, PA, Jacksonville, TX, Ozark, AL and Danville, VA are expected to decrease by more than 10%. The general consensus is for national housing prices to increase 2% next year. This serves as a reminder that deciding where to buy your next house could be one of the biggest financial decisions you make in your life.

Appreciation is driven by economic, environmental and social issues although a high demand coupled with limited inventory levels seem to be the primary factors currently driving appreciation nationwide. With interest rates nearing historic lows and millennials aging into prime home buying years (nearly 87% of first-time home buyers are 26-34 years old) and a sudden move away from urban areas driven by COVID-19, housing inventory has become limited in many areas of the country. This has driven up pricing. The median price of an existing single family home in Q3 2019 was 280,000 compared to 313,500 in Q3 2020, a 12% increase, according to the National Association of Realtors. Still, real home values (home values adjusted for income changes and inflation) are still 37.9% below the pre-recession peak.

If you are going to be looking for a house in the near future, expect to find a competitive market with numerous other buyers. While pricing has been driven up there is no indication that this is a bubble or that prices nationwide will start declining. Interest rates are expected to be low for some time and once Covid-19 has a vaccine and employment levels start to rebound house prices should stay relatively stable.

For more advice on investing in a house, talk to one of our loan officers. They can be reached here.