If you have bad credit, it doesn’t necessarily mean that you can’t get a mortgage.

When deciding on whether or not to lend to someone, lenders try to assess your ability to repay. A credit score is just one input they consider. They also look at things like the reason for the low credit score, job history, income stability, and your overall debt level.

What is Considered a Poor Credit Score?

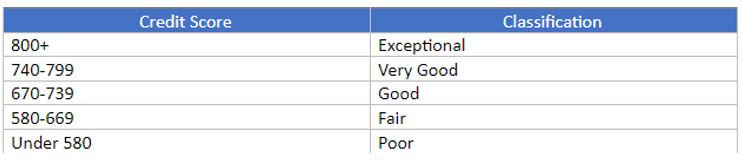

The standard measure of credit scoring used by the credit bureaus and lenders is the FICO Score, created by Fair Isaac Corporation. In their rankings, any score under 580 is considered poor.

If your score is in the lower end of the scale above, the first thing you should do is closely review your credit report.

Credit reports are known to have mistakes. You can call the credit bureau and dispute things like inaccuracies, incomplete or outdated data, incorrect payment statuses, and credit records that aren’t yours. If you find a mistake, address it right away. It may take time to resolve, and a lender typically won’t let you close on a mortgage if there is a dispute on your credit score.

If your score is below 500, you are going to have a tough time finding a lender. It would probably be best to work on repairing your credit before you buy a house.

How A Low Credit Score Affects Your Mortgage

As mentioned, the lender is looking at your ability to repay. A low credit score might mean adjustments to the other elements that a lender typically considers.

- Larger Down Payment. – You might be asked for a higher down payment. This gives the lender a bigger equity cushion and less money for you to pay back. The bigger equity cushion ensures that you are likely to do everything possible to make your payments rather than risk the money invested in your house.

- Higher interest rate. – Interest rates compensate lenders for the risk they are taking. A lower credit score reflects a higher risk level, and lenders will want to be compensated for this higher risk.

- Higher closing costs. – The lower your credit score, the fewer lenders you will have to choose from. This makes it hard to shop for lower closing costs like origination or lender fees. Also, if you are planning on staying in your home for a long time, it might be beneficial to buy down those higher interest rates by paying points at closing.

- Higher Mortgage Insurance Rates. – If you don’t have a score above 620, your mortgage might have to be backed by a government institution. These institutions guarantee your mortgage payment to the lender and, in return, charge borrowers who enter their loan programs up-front fees, which are paid at closing, and monthly mortgage insurance fees.

- Lender May Adjust Other Criteria – They may adjust other factors they use when approving a mortgage to compensate for the lower credit score. For example, they may lower the debt-to-income ratio allowed or minimum income levels.

How Do I Get a Mortgage with a Low Credit Score?

You can take several steps to help your chances of getting a mortgage with a low credit score:

- Larger Down Payment – Don’t wait for a lender to ask for a larger down payment. Be prepared to offer one. This will give the lender confidence in you as a borrower and reduce their risk level.

- Low Debt Levels – Even though your credit isn’t good, that doesn’t mean you have a lot of debt. Try to reduce overall debt levels like car payments, student loans, credit cards, and other recurring debt.

- Make Sure You Have No Debt in Collections – If others are already having problems collecting from you a lender is going to be less likely to want to put themselves in a similar situation.

- Co-Signer – You can get someone to co-sign a mortgage for you. Realize that you will be asking a lot of this person. If you don’t pay the mortgage, they will be responsible, and their credit will be impacted. In fact, their credit is likely to be impacted by the fact that they have taken on such an obligation, making it harder for them to borrow for other needs.

- Only Use One Partner to Apply – the second partner can transfer assets to this partner. This way, one partner’s bad credit isn’t an issue. Be careful with this, though. The partner that applies for the mortgage will have their name on the deed and be the sole legal owner of the house. For married couples, this isn’t usually an issue. Non-married couples might want to have an attorney draft another agreement that details what happens if there is a separation.

What Types of Mortgages Can I Get with a Low Credit Score?

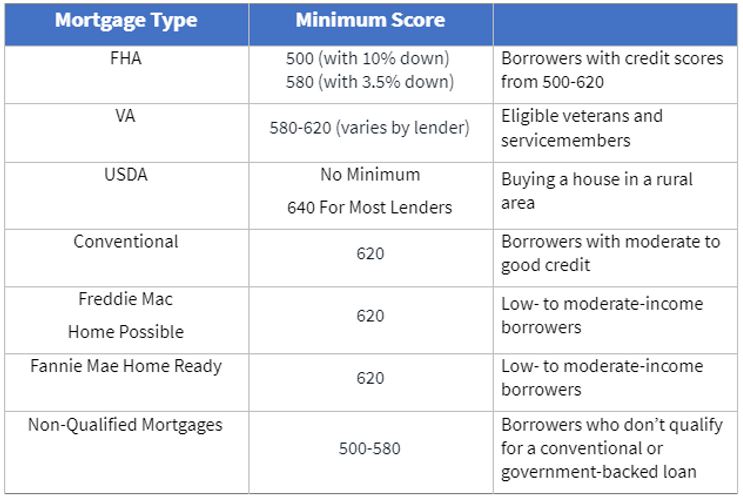

Some mortgages are specifically designed to help low credit borrowers get into homes. Most are backed by government institutions that insure the mortgages.

Loan Program Specifics

- FHA – stands for the Federal Housing Administration. These loans are popular for a few reasons. For one, they contain the lowest credit score requirements of any major home loan program. If you have a credit score of 580 or higher, you can get a loan by only putting 3.5% down. You can borrow with credit scores as low as 500, but you will just have to put 10% down.

Additionally, lower credit scores aren’t penalized with higher interest rates the way they are with conventional mortgage loans (non-government loans). While you may pay a higher interest rate, it is likely to be less than you will find from other lending programs.

Note that if your low credit is due to a chapter 7 bankruptcy filing or a short sale, you may have to wait two years or show improvements to your credit before being approved for an FHA loan.

- VA – stands for “Veterans Affairs,” which is the department that backs these loans. They are offered to service members, veterans, some eligible spouses, and other military-affiliated borrowers. Technically there is no minimum credit score for a VA loan, but most lenders require a minimum score in the 580 – 620 range.

Similar to VA loans, these loans don’t adjust interest rates based on credit scores. Applicants with low scores can get rates similar to those given to borrowers with higher credit scores.

- USDA – stands for United States Department of Agriculture. Though these loans have no credit minimum, most lenders will ask for a 640 FICO or higher. These loans were designed to increase homeownership in rural areas. To qualify, you must buy a home in a “qualified” rural area. There are also income requirements. Your household income can’t be more than 15 higher than the median income in your area.

- Non-Government Conventional Mortgages – Fannie Mae and Freddie Mac administer most of the conventional loans. It is rather ironic that you have government entities doing most of the “non-government” mortgages (This is because prior to the financial crisis Fannie and Freddie were private companies. The Government took them over to keep them solvent during the crisis).

These loans adjust their interest rates based on the two loan factors, the ratio of the loan amount to the value (LTV) of the home and the credit score. High LTV’s and lower credit scores mean higher interest rates.

Most lenders will require a FICO of 620 for these loans. While they might offer conventional loans at lower FICO scores the higher rates usually make FHA loans a more attractive option.

- Freddie Mac Home Possible Program – To qualify for this program, most lenders will look for a 620 credit score. The program was designed for low to moderate-income borrowers looking to buy a first home. It requires a down payment of only 3%.

- Fannie Mae HomeReady Program – like Home Possible, this program is designed to help low to moderate-income borrowers. You only need a 3% down payment, and most lenders will require a 620 FICO Score. HomeReady, though, isn’t just for first-time buyers. It also has a unique feature in that it lets you include income from other members of the household other than just the borrower. You can include the income of roommates, adult children, and parents in your debt-to-income ratio.

- Non-Qualified Mortgages – In 2014, the federal government created a category of loans designated as “qualified mortgages”. To be a qualified mortgage, a loan couldn’t have criteria designed as high risk – things like balloon payments, negative amortization, or interest-only payment periods. A lender offering a “qualified mortgage” also has to go through a good faith effort to determine if you can repay. Qualified loans offer the legal lender protection against investor buy-back demands.

When a lender doesn’t sell their loan to an investor, they don’t have to meet the investor guidelines. They are free to set their own rules and offer more flexible criteria with lower minimum credit score requirements. While you might find a Non-QM lender that will accept a credit score as low as 500, you are much more likely to find one if you are 580 or higher.

Conclusion

There are mortgages available if you have a low credit score. You just might have to work a little harder trying to find the one that fits your situation. While you can find a loan with a score as low as 500, if you can get your score up to 580 or 620, you start opening up more options.

The best way to find the right loan is to work with a loan advisor that can work you through the options and information needed to qualify. At EMM Loans, we are experts in FHA, VA, USDA, Conventional, Fannie Mae, Freddie Mac, and Non-Conventional loans. We work with a broad range of loans to help people like yourself find the best option.