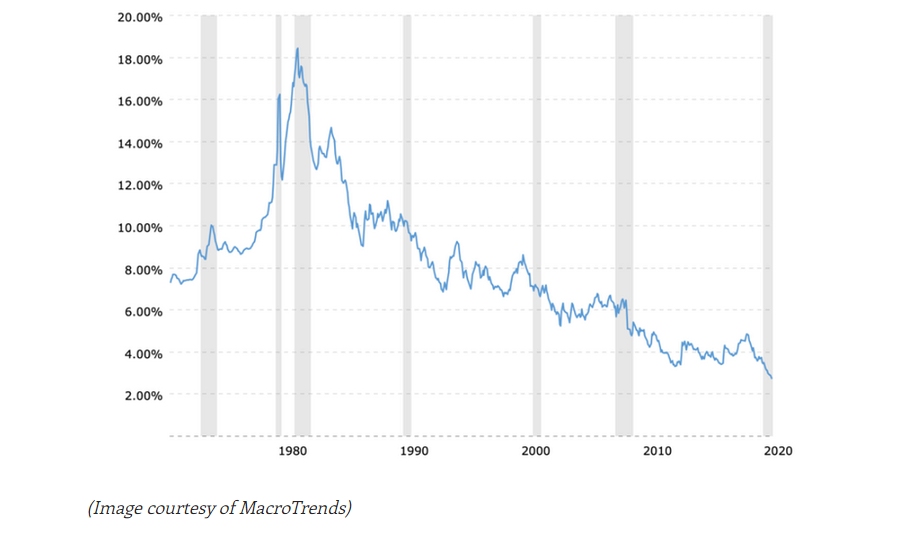

With interest rates setting record lows, for many homeowners, now is a great time to refinance. Interest rates, however, are often just one factor that plays into a refinancing decision. Credit scores, home equity levels, job security and expected time in the home are also things to consider.

In November 2018, the 30-year fixed rate mortgage was around 4.81%. That means for every $100,000 in mortgage money someone borrowed, they would have to pay back $525 in principal and interest. Today the interest rate is around 2.72%. This means a payment of $407, a 22.5% reduction in your monthly payment. That’s a significant savings.

Interest Rate For 30 YR Fixed Rate Mortgage – April 1971 – Present

(Image courtesy of MacroTrends)

People are realizing this. According to the Mortgage Bankers Association, the refinance share of mortgage activity increased to 71.1 percent of total mortgage applications. Refinance related mortgages are expected to increase from $1.02 trillion last year to $1.97 trillion this year. That is almost double. This year refinances are expected to make up 17.7% of all mortgage debt outstanding.

What Are the Reasons People Think About Refinancing?

Sure, getting a lower payment due to a lower interest rate is a great reason to refinance. But there are other reasons as well. Typically, people start thinking about refinancing when:

1. They Are Anticipating A Decline in Income

This might be a good time to consider moving from 15-year mortgage to a 30 year. The current interest rate for a 15-year mortgage is 2.28%. For the 15 year the principal and interest payment would be $656 for every $100,000 borrowed. That’s 61% higher than the $407 payment on the 30-year mortgage (see example above). Extending the payment terms another 30 years can help offset the reduced income.

2. They Want to Pay Off the Loan Quicker

Since interest accrues and is usually front loaded, paying off a mortgage more quickly can save money over the long term. This is the flip side of point number one. If they can afford the higher payments refinancing from a 30-year loan to a 15-year loan, they can save thousands.

3. They Have Built Up Equity

If the home value has increased or if the mortgage has been paid down, they will have a lower loan to value ratio (LTV). The lower the value, the less risky the loan is perceived to be. The lenders figure the borrower is more likely to sell and repay them rather than default. Because the borrower is perceived as lower risk they might qualify for a better rate. If the LTV falls below 80% and they have been paying mortgage insurance up until this point they can refinance and eliminate the mortgage insurance fee.

4. They Need Money

If the homeowner needs money, they can do a cash-out refinance. This allows a borrower to cash out some of the equity that has built up in the home. Often the money is used for renovations or repairs, but it can also be used for other expenses such as medical costs or education. Lenders view cash-out refinances as riskier than standard rate and term refinances so the interest rate is typically higher. A borrower may also be required to have an LTV of 80% or lower after the refinance. With interest rates so low the payment might still be lower, even with a cash-out.

5. They Have Improved Their Credit

By paying bills on time, paying down debts and lowering their overall credit utilization, people are able to improve their credit scores. Depending on the specifics of the loan, a 20-point boost in credit score could lower the rate enough to save thousands over the life of the loan.

6. Their Fixed Period on Their Adjustable Rate Mortgage Is Ending

Adjustable rate mortgages often save money during the early years of home ownership. Once the fixed rate period ends though, the interest rate can increase quite a bit. People often move to a fixed rate at this time. Even though the fixed rate may be higher than your original adjustable rate, borrowers are protected against future rate increases. And with rates as low as they are today, there is a case to be made for borrowing as much as possible for as long as possible.

7. Job Uncertainty

I know, it sounds crazy to be thinking about refinancing if there isn’t have a strong foundation at work. After all, the closing and origination costs associated with a refinancing often take a few years to recoup. If something should happen at the job the house might have to be sold before the costs are recovered, thus eliminating the benefit of refinancing. If there is the potential to lose a job a borrower can explore rolling the closing costs in the loan amount or increasing the interest rate. Then do the numbers. If a borrower can roll the costs in and still have a lower payment thanks to the low interest, then there isn’t a downside. They recoup right away and buy themselves some liquidity.

Credit scores, how long someone’s planning on staying in the house, the prognosis for a steady income (something that Covid has made more uncertain), and of course interest rates, are all factors that play into a refinance decision. The best way to assure you are making the right decision is to get help from someone who analyzes these types of things for a living.